Powering the Green Economy

Cobalt is used in almost every lithium-ion rechargeable device on the planet – from smartphones to smartwatches, tablets to laptops, electric vehicles to solar and battery systems in homes.

You need cobalt if you are sending an email, browsing the internet, checking social media, travelling by car, aircraft, or spaceship.

The metal is also extensively used in superalloys, vital for almost all high-temperature and extreme pressure applications, particularly wind power generation, aviation, and travel industries.

The Cobalt Market

Learn more about Cobalt demand through our extensive report on the global market.

The Cobalt Institute's

Cobalt Factsheet

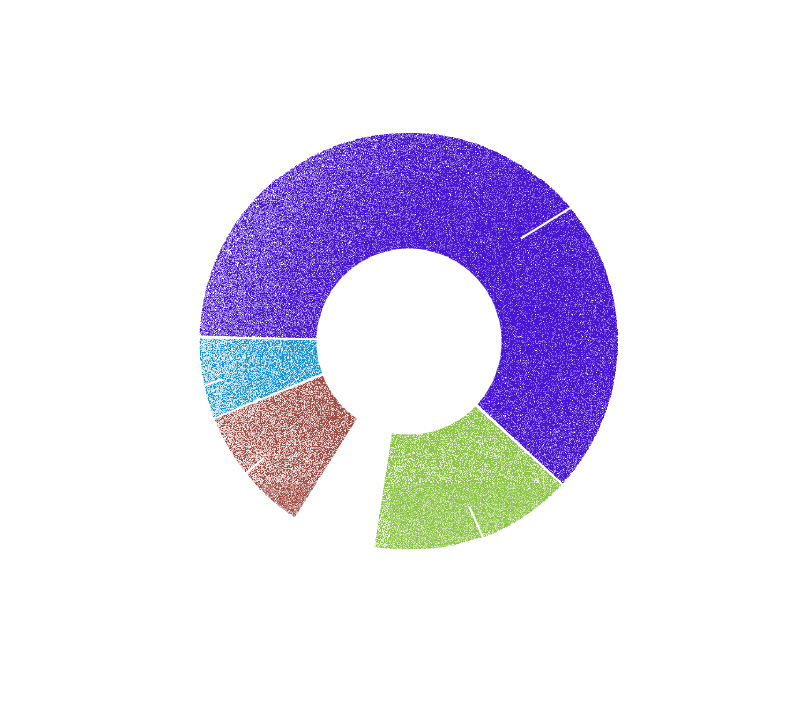

Cobalt Demand

The new economy has arrived. More people than ever are using technology in their daily lives and this will continue to dominate cobalt demand for the foreseeable future.

Back in the mid-1990s, batteries represented only 1% of cobalt demand (~1,000 tpa). The introduction of lithium-ion technology has changed everything. Now, cobalt demand is around 70,000tpa and as the new economy grows, so will the demand for cobalt.

Cobalt demand breakdown

(% end use by industry)

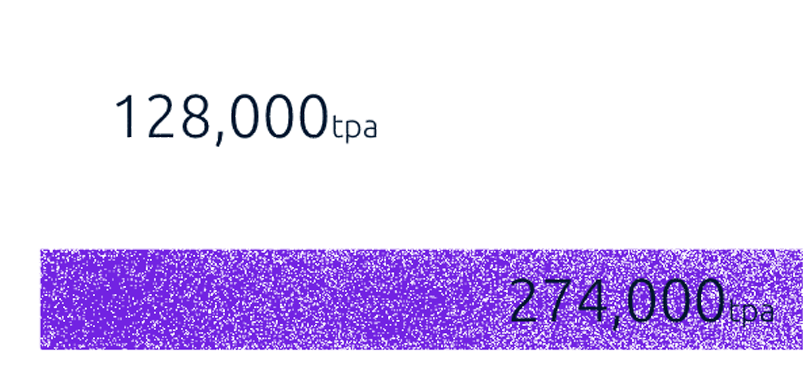

Cobalt demand forecast

(total market size)

Powering the future

Today, most portable applications are powered by cobalt-based lithium-ion batteries. As a result, cobalt demand is now split into ‘new’ and ‘old’ economy drivers.

In the new economy, it’s batteries that require cobalt. Batteries store energy in an era of high energy prices. They play an essential role in the decarbonisation of power grids. They are powering the massive growth of Electric Vehicles (EVs) worldwide.

While still current today, the old economy is more industrial and metallurgical, where cobalt is used in Superalloys, Magnetic Materials, and Catalysts.

The Global Backdrop

The Inflation Reduction Act (IRA) in the United States of America (US) and Critical Raw Materials Act (CRMA) in the European Union (EU) are significantly impacting the global critical minerals supply chain. This will provide incentives for supply from Allied Nations, including Australia.

The global race to secure IRA and CRMA compliant supply is rapidly advancing an Allied Nation critical materials supply chain.

Cobalt Blue is entering the global critical minerals market at a very exciting time.

Recent legislation in the US and EU is impacting the global critical minerals and battery manufacturing supply chains

The IRA includes ~US$390Bn of spending/credits over the next 10 years related to energy and climate change. This aims to put the US on a path towards 40% emissions reductions by 2030.

The US Treasury Department wants to remain strict on sourcing and content requirements in order to trigger more announcements in EV production and battery investment aligned to US interests.

US Treasury defines critical minerals to include cobalt and other EV destined metals.

The critical mineral requirement is met if the percentage of total mineral value in the battery made in North America or countries with a Free Trade Agreement (FTA) - such as Australia - is 40% in 2023 (increasing to an 80% ceiling after 2026).

One of the key tax credits is the Clean Vehicle Credit (CVC): this provides a US$3,750 tax incentive to US consumers for purchasing an EV containing a threshold level (peaking at 80% value definition by 2027) of critical minerals, where production or processing are performed within an FTA country.

COVID supply chain disruptions and the Russia-Ukraine war have exposed EU dependency on critical raw materials. The EU CRMA is aiming to mitigate these dependencies through:

1. an onshore Critical Raw Materials (CRM) supply chain

2. supply chain diversification

3. sustainable sourcing including circularity (recycling)

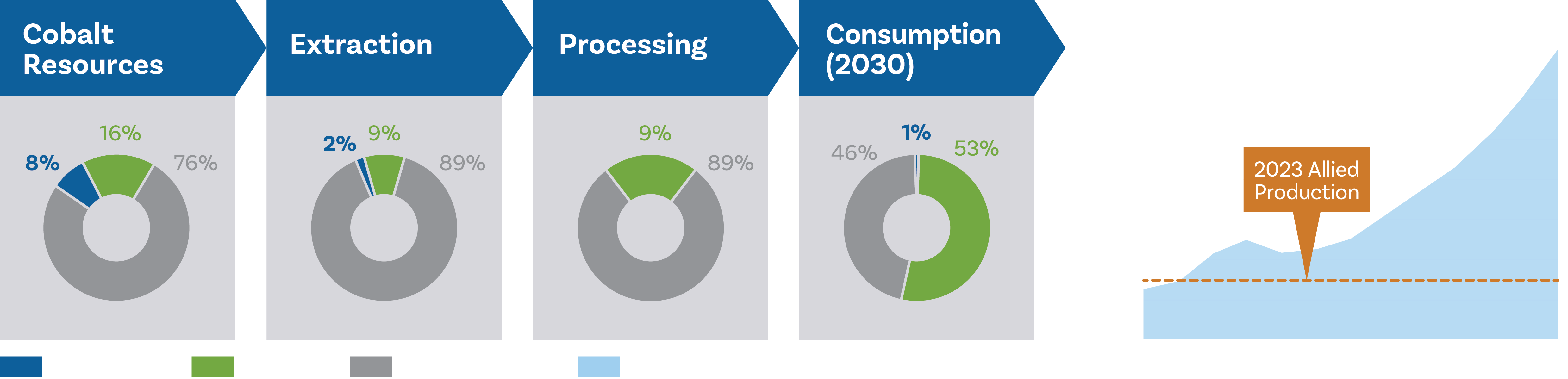

The US has defined Foreign Entities of Concern, which are excluded from assistance under the IRA. The mining and refining industries of Allied Nations (EU, UK, Japan, South Korea, Australia, and other strategically aligned countries) are being incentivised to respond.

The EU and US are attempting to incentivise new supply chains – a so called “race to the top”. This may lead to a new cobalt pricing index… and a premium for IRA and CRMA compliant cobalt.

With Allied Nations currently producing ~30,000tpa of cobalt metal, this amount will need to increase to 140,000tpa by 2030 to meet its own demand. This shortfall can only be overcome through new supply chains, including new mines and refineries.

The Climate, Critical Minerals and Clean Energy Transformation Compact

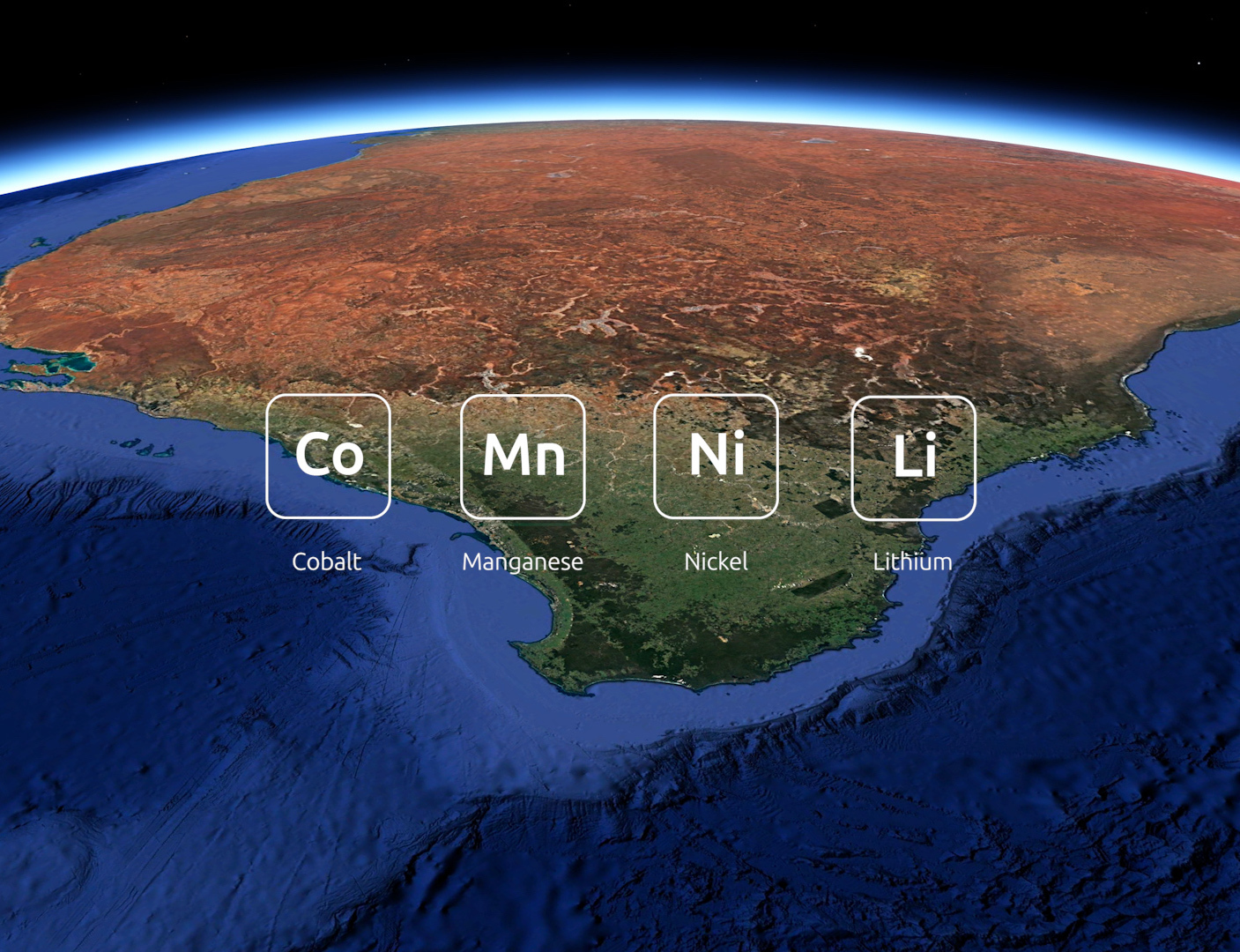

Australia has relatively large reserves of all the major components in lithium-ion battery chemistry (Lithium, Manganese, Nickel and Cobalt).

A recent compact between the US and Australia advances the prospects for Australian critical minerals projects with greater availability of grants, loans, rebates, incentives, and investments.

Industries

Cobalt batteries

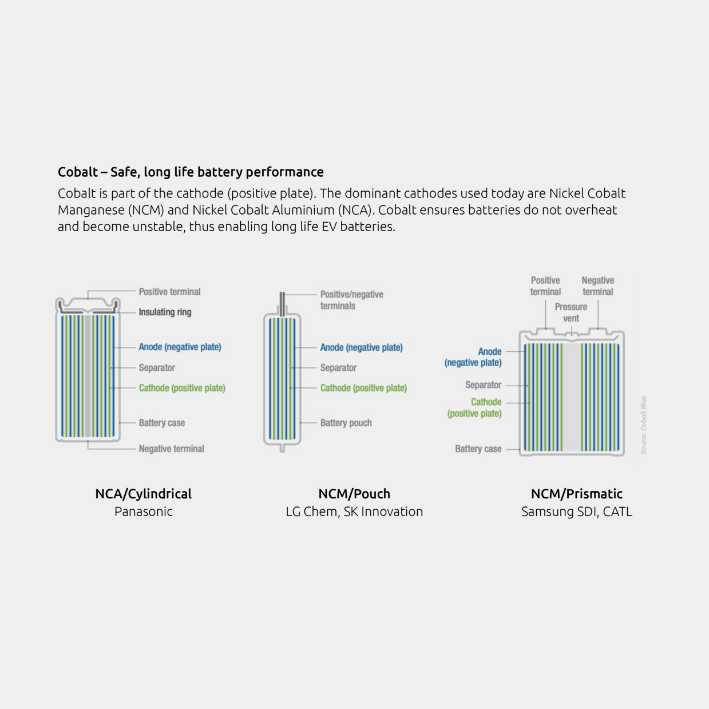

The Sony Corporation first commercialised cobalt-based lithium-ion batteries over 30 years ago. Cobalt-based batteries are an improvement because they have high specific energy vs. weight, they can hold charge and power over time, and are generally maintenance-free.

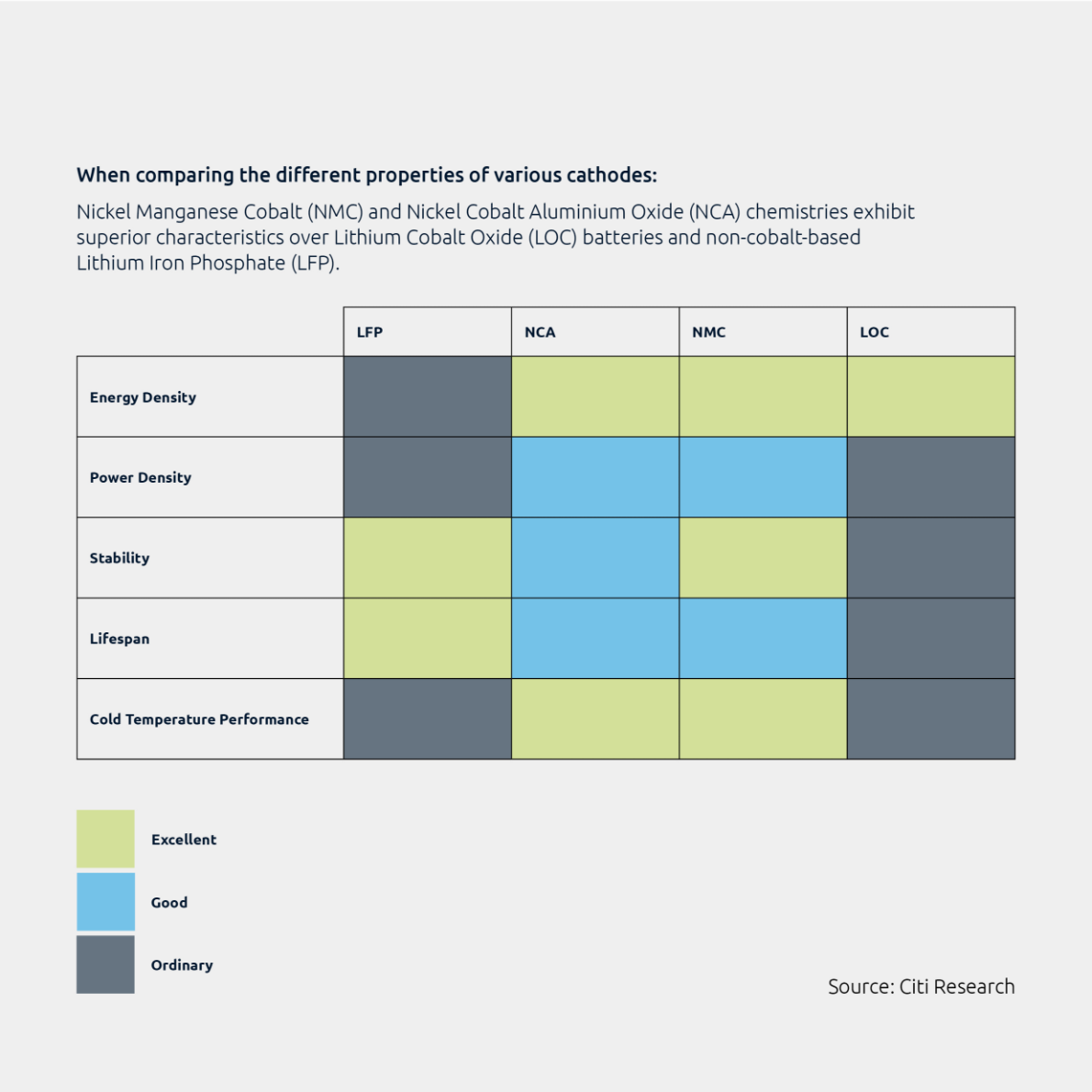

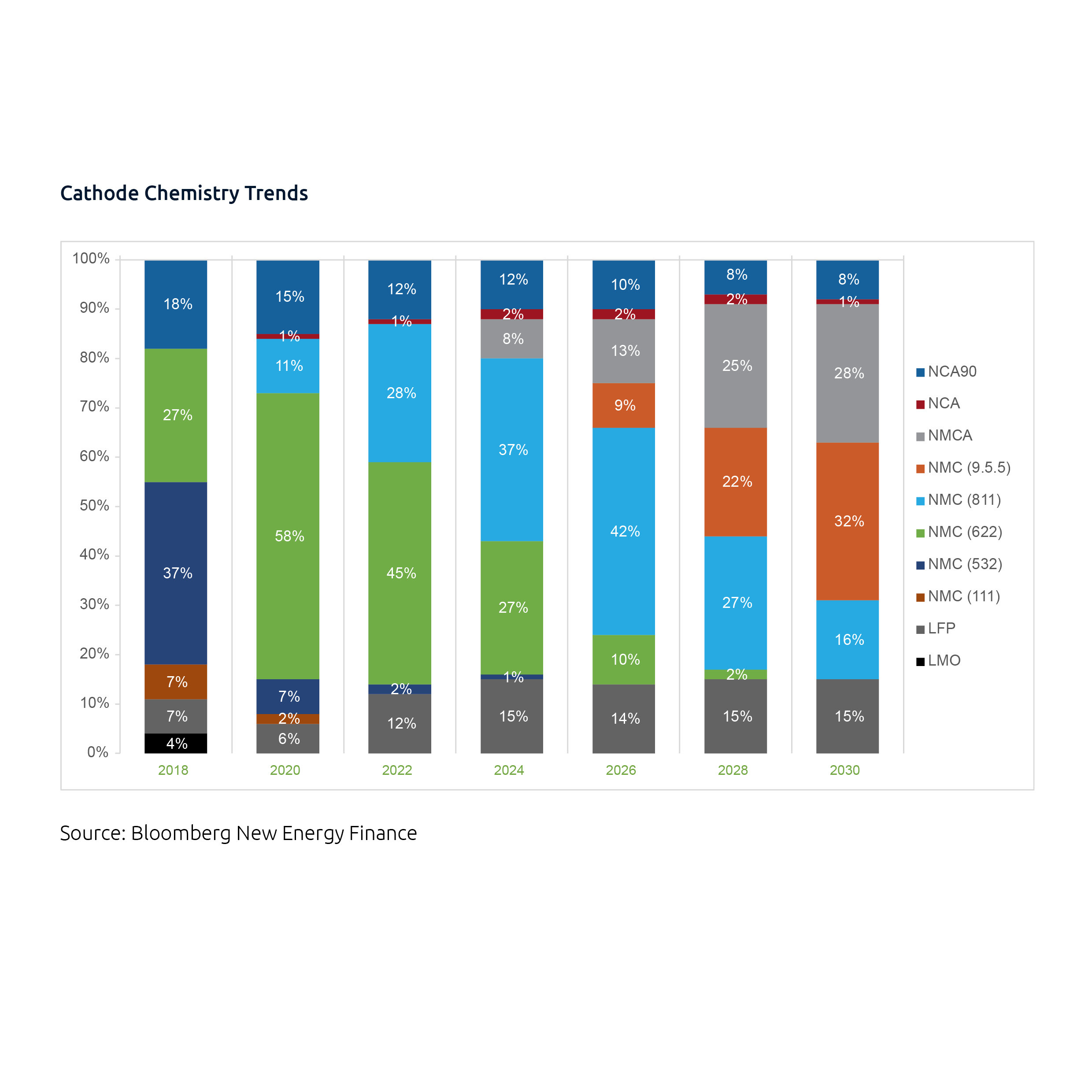

When comparing the different properties of various cathodes: Nickel Manganese Cobalt (NMC) and Nickel Cobalt Aluminium Oxide (NCA) chemistries exhibit superior characteristics over Lithium Cobalt Oxide (LOC) batteries and non-cobalt-based Lithium Iron Phosphate (LFP).

It’s this combination of energy density and stability that makes NMC cathodes the EV batteries of choice. NMC cathodes will supply 85% of the total EV battery market by 2030. While cathodes will undoubtedly contain less cobalt in the future, the sheer growth in EVs will drive strong cobalt demand.

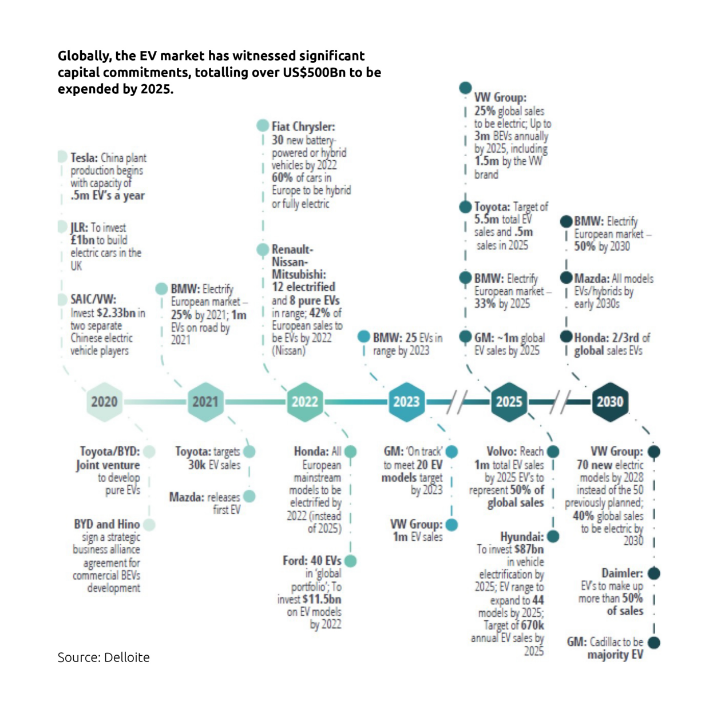

Electric Vehicles (EVs)

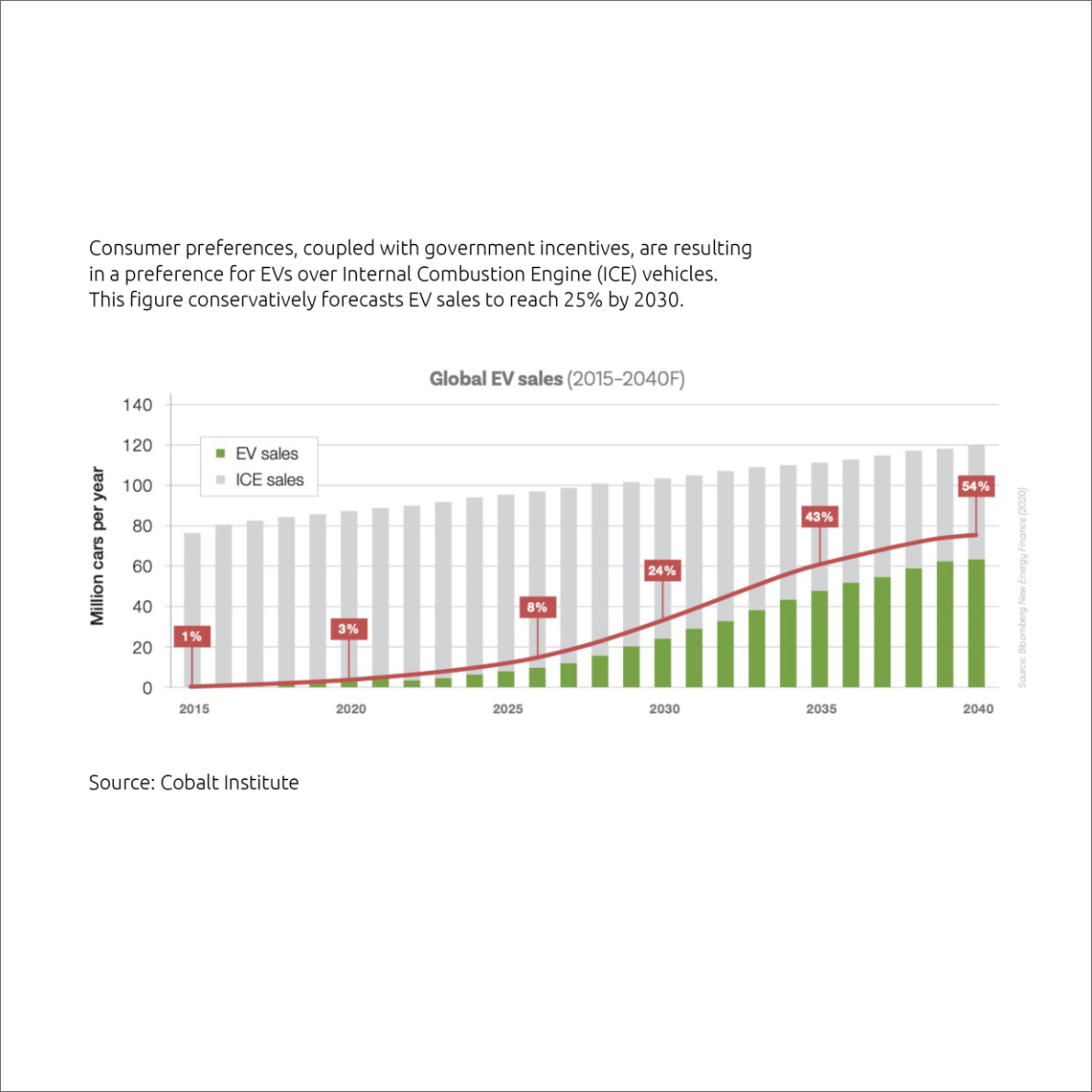

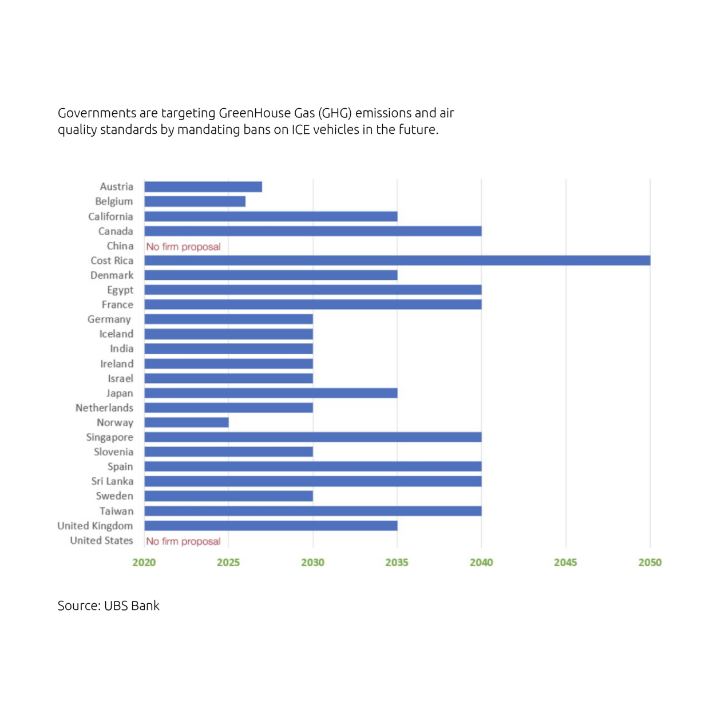

Compared to Internal Combustion Engine (ICE) vehicles, EVs offer cost savings and environmental advantages. Many governments around the world are targeting GreenHouse Gas (GHG) emissions and air quality standards by mandating bans on ICE vehicles in the future.

With changing consumer preferences and government incentives, EVs are set to make up more than half the number of global passenger car sales by 2040. They will ultimately dominate the market. In doing so, they will increase the demand for cobalt, which is integral to the lithium-ion battery pack used in hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs), and all-electric vehicles (EVs), including commercial trucks, buses, and electric bikes.

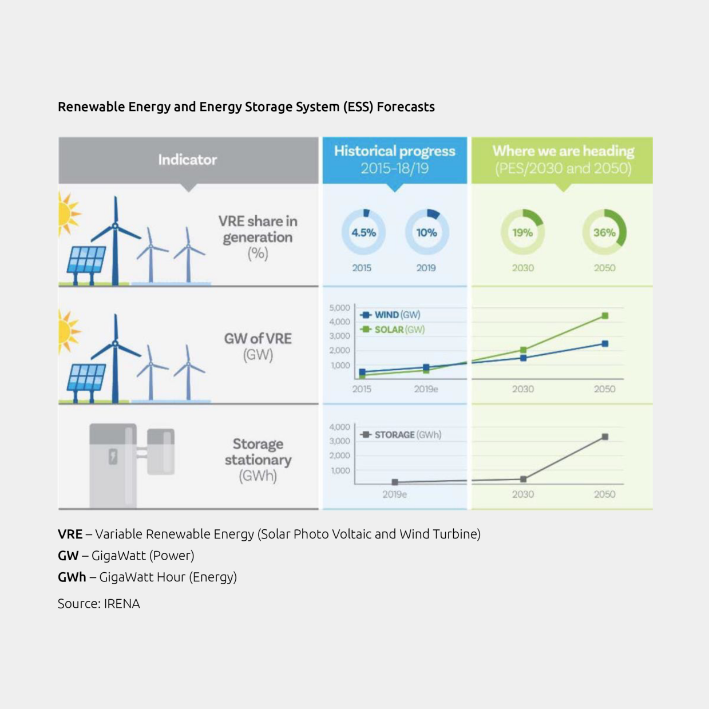

Powering green energy

An Energy Storage System (ESS) is a system that stores surplus power and supplies it when needed to improve power efficiency. A key driver of growth in energy storage is the co-location of renewable energy production facilities with energy storage assets (batteries). This combination stabilises production and ensures a supply of energy during peak demand periods.

While the use of renewables is growing, so is energy demand. As the share of modern renewable energy in final energy supply increases, there is a significant role for cobalt to power the future of green energy globally.

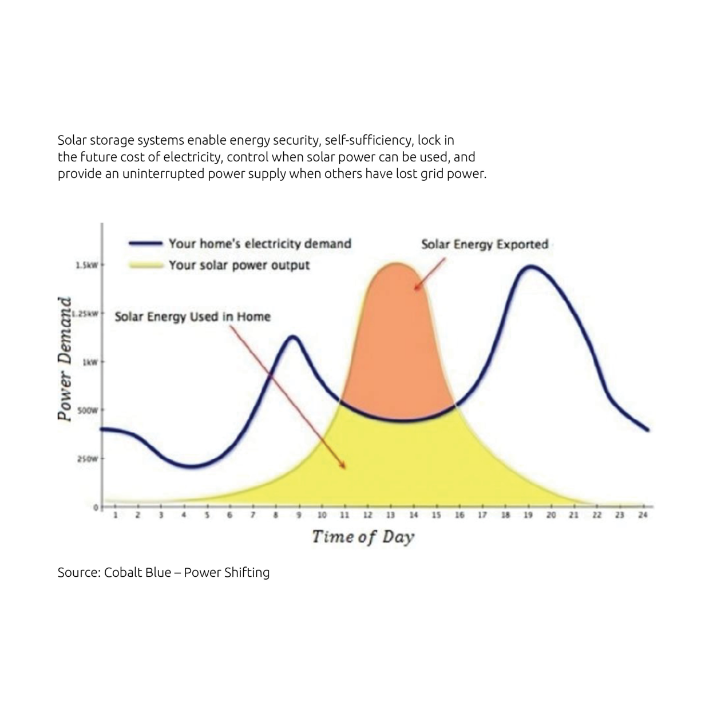

Power shifting

Power shifting is a game-changer that enables energy to be stored and used whenever it’s needed. The powerful batteries required for household power storage need cobalt.

With solar panels being cheaper than ever to produce, an increasing number of people are installing them on their homes. Unfortunately, they capture the most energy when the sun is shining brightest and the power is least needed. The majority of that power is then fed back into the grid.

Fragile & Unethical Cobalt Supply

Cobalt ranks 33rd in the abundance of all metals in the Earth’s crust. It is widely scattered, yet it appears in economic quantities in less than 20 countries globally. The majority of cobalt (98%) is a by-product of either copper (primarily African sources) or nickel (rest of world) mining. That is why in most mines, cobalt production is incentivised by firmer nickel or copper prices rather than on its own merits. This makes it challenging to expand cobalt production to meet market requirements.

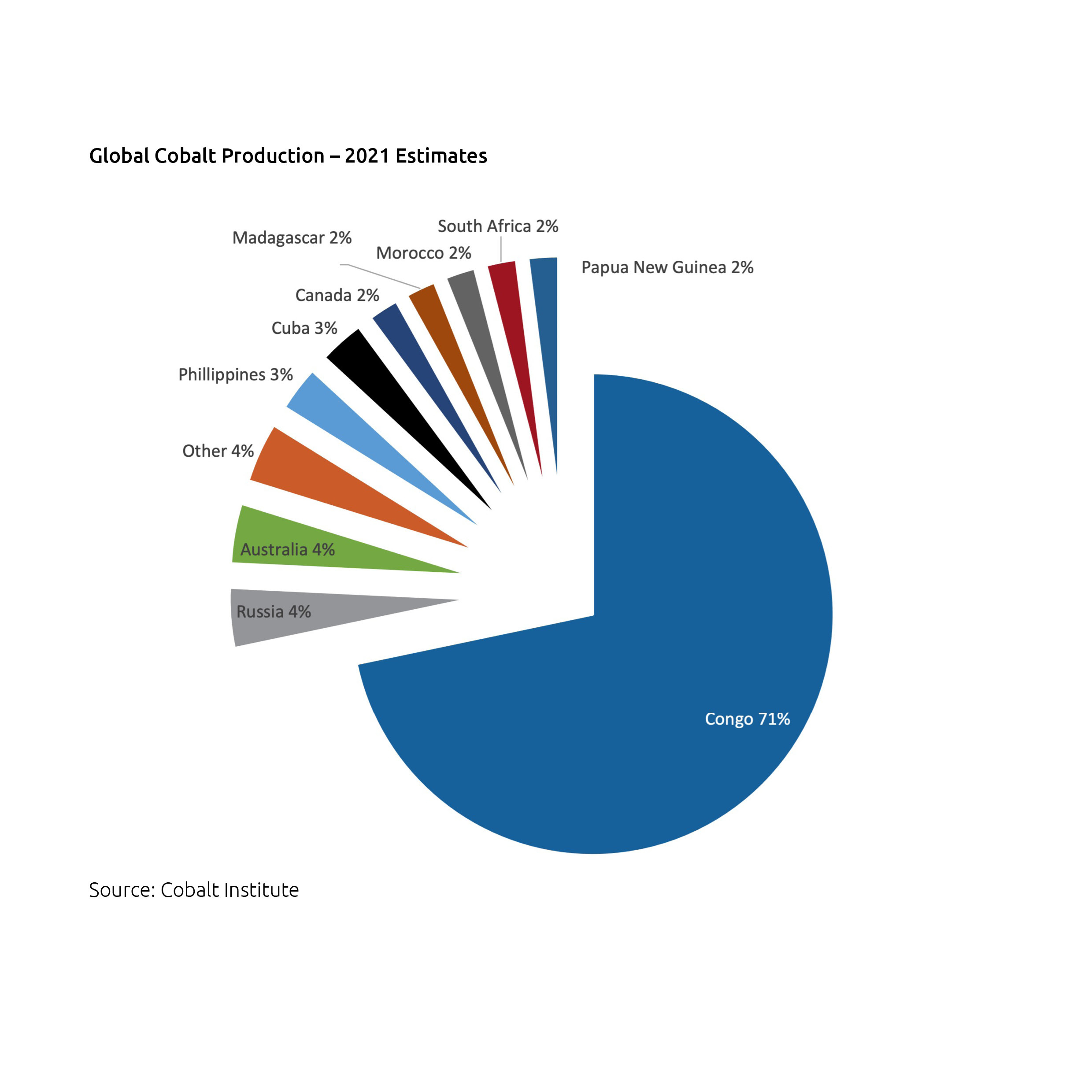

The Democratic Republic of Congo (DRC) currently supplies 71% of the world’s cobalt. As a developing African nation, the DRC has been plagued by corruption, conflict, and child labour issues and is widely considered one of the world’s highest sovereign risk locations. It is also one of the world’s poorest countries and has had more deaths from war than any other country since World War II. The DRC ranks:

- 151 out of 159 countries in the Human Freedom Index

- 176 out of 188 countries in the Human Development Index

- 178 out of 184 countries in terms of GDP per capital

- 148 out of 169 countries in the corruption perceptions index

- 82 out of 83 in the Fraser Institute of mining risk survey

Superalloys

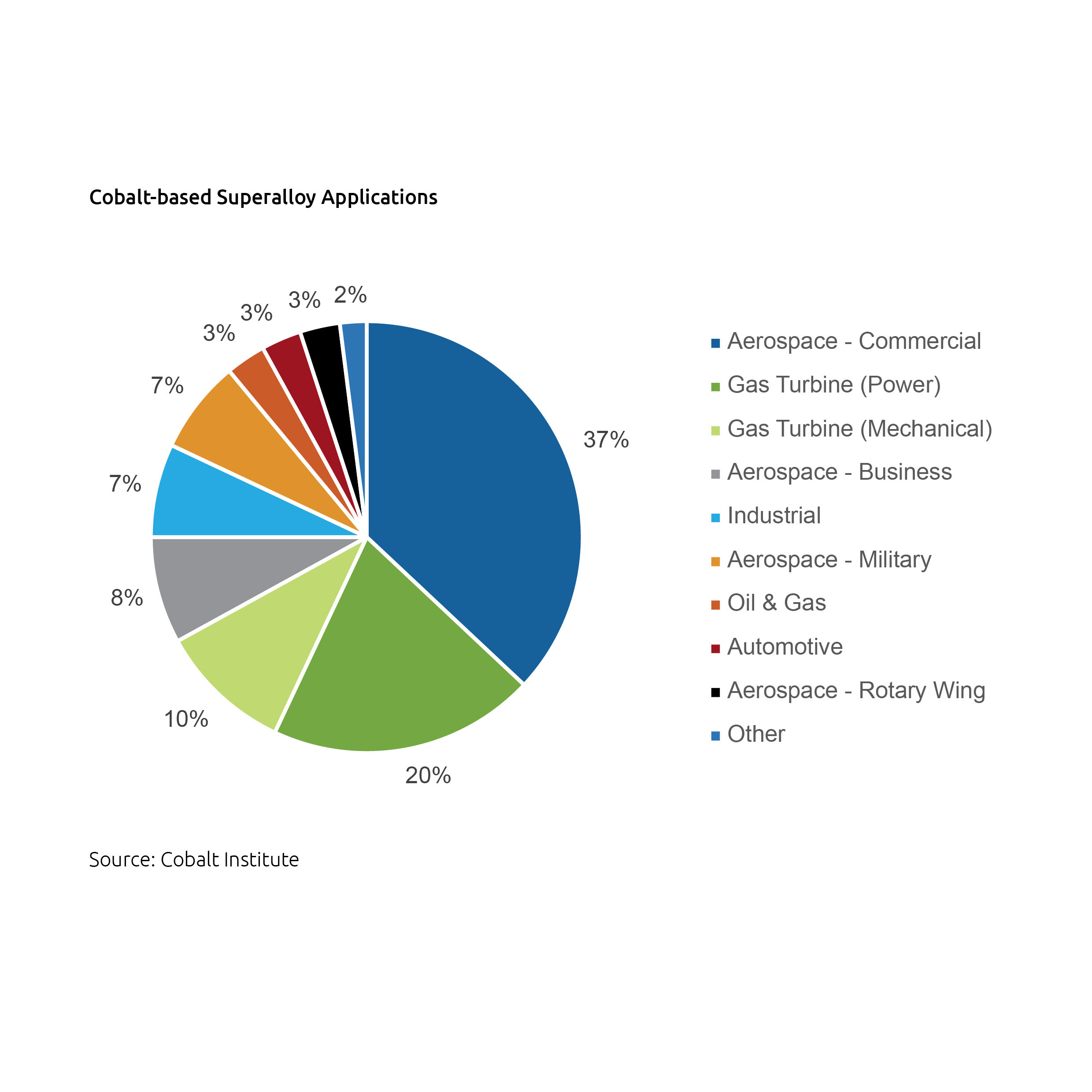

Cobalt is one of the main alloying elements in superalloys, primarily aerospace, defence, nuclear power, gas turbines, and automobiles.

Superalloys can withstand high temperatures (typically >6000C) and high stresses. They exhibit other superior characteristics, like mechanical strength, resistance to thermal creep deformation, good surface stability, and resistance to corrosion or oxidation.