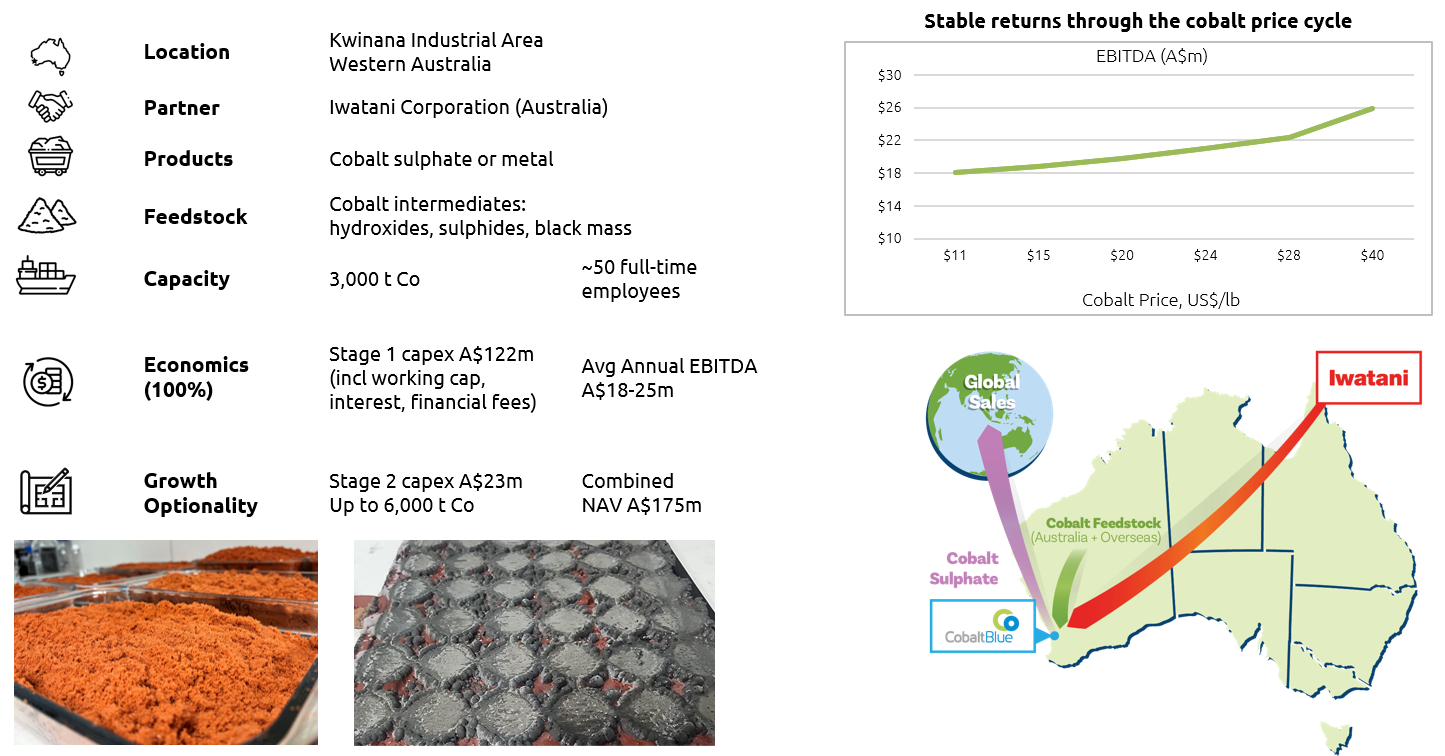

KCR will aim to build a secure a cobalt supply chain by developing mid-stream processing from multiple feedstocks

Refining is fundamentally an economy of scale business. A single, larger refinery would allow Cobalt Blue to process future material sourced from:

- Third party sources, domestic and international (typically nickel/cobalt producers) and Recycled battery Black Mass

- Broken Hill Cobalt Project and (in future) other Cobalt Blue owned cobalt projects

Key project metrics:

- Pre-tax NPV 8% (real) of A$130m

- Pre-tax Internal Rate of Return of 31%

- Start-up Capex of A$60m

Key project advantages

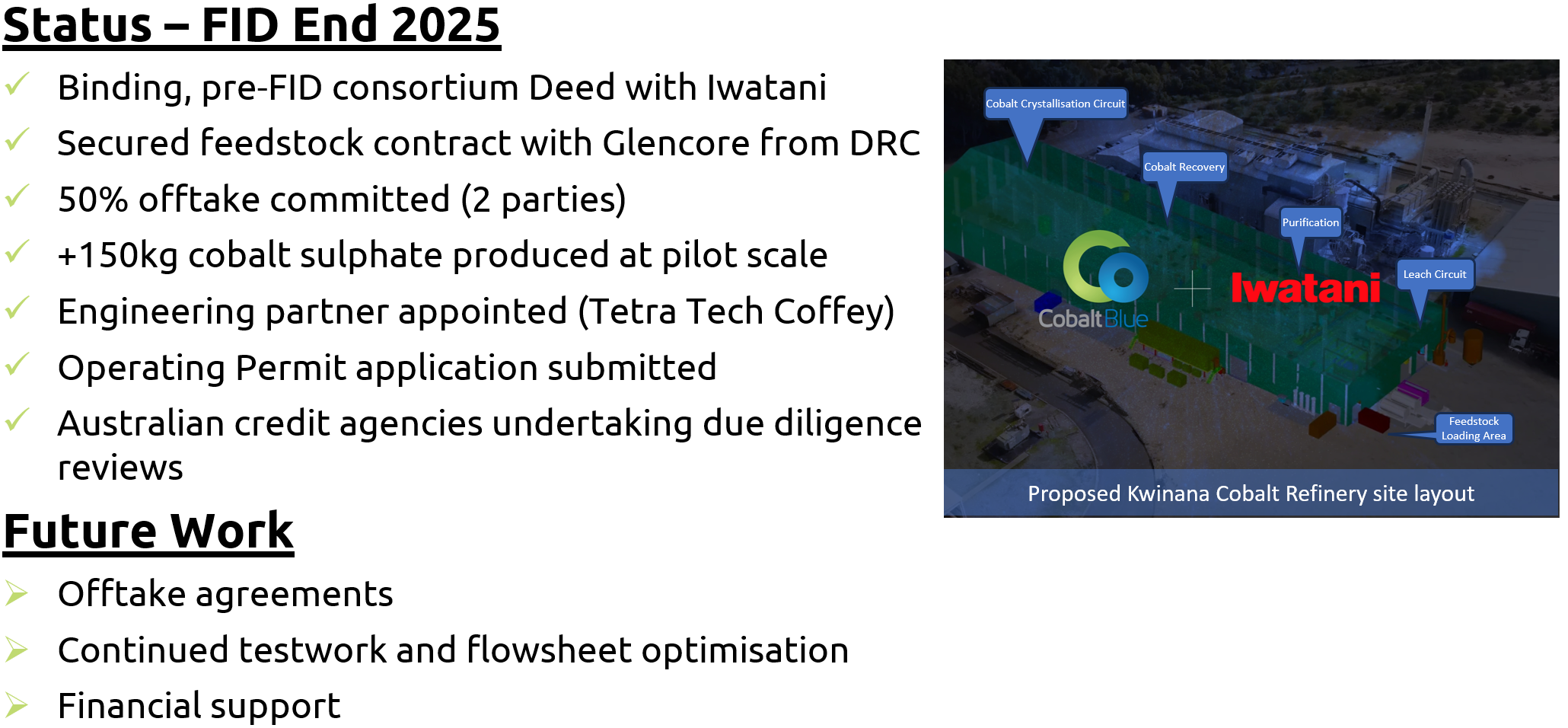

Current Project Status

Access to import and export markets

Kwinana has deep water ports and export facilities. Cobalt sulphate is a fragile product that absorbs water (particularly in hot/humid regional conditions) if left exposed and requires specialised storage and shipping.

Direct port access provides a meaningful advantage compared to a more remote location - for importing third-party feedstock for refining and exporting product.

Cost advantage

Kwinana is a major chemicals district. Typically, up to 60-70% of the costs associated with conversion from Mixed Hydroxide Precipitate (MHP) to cobalt sulphate come from reagent and chemical costs. This location provides more ready access to chemicals with lower associated logistical costs.